What actually happens during a CRA review? A step‑by‑step walkthrough

What is a CRA review.

Explaining Compilations: What They Are and Why They Matter

Compilation financial statements.

Section 85 Rollover: What Sole Proprietors Need to Know When Incorporating

Section 85 rollover when incorporating a sole proprietorship.

Charitable Giving in Canada: Should You Donate Personally or Through Your Corporation?

Charitable giving tax treatment: personal vs. corporate.

T2125 Prep for 2025: A Sole Proprietor’s Guide to Stress-Free Tax Filing

T2125 Self-employment business schedule for 2025 personal tax season.

Estate Trust Returns: Filing Requirements and Administration for Executors

Estate trust returns.

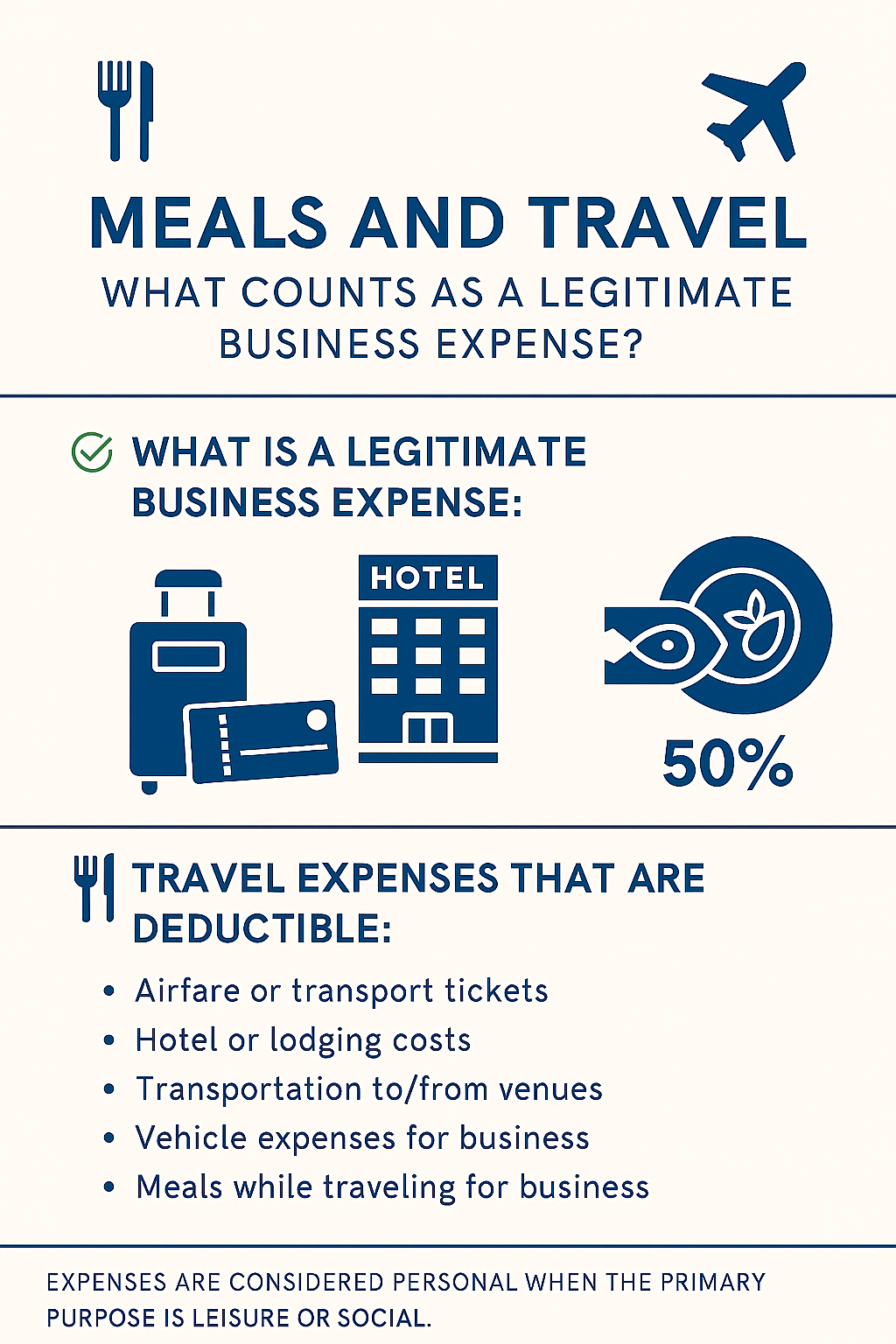

Meals and Travel: What Counts as a Legitimate Business Expense?

Business meal and travel expenses.

Shareholder Guide: How to Properly Account for Business Use of Personal Vehicle and Home

Business use of personal assets.

Cash Flow Tips for New Corporations: Planning for Tax Obligations Without the Panic

Cash flow tips for a corporation.

Short-Term Rentals in BC: What CRA Wants to See in Your 2024 Tax Return

Tax implications of short-term rentals.

Confessions of an Accountant: 5 Things I Wish Clients Knew

5 things I wish my clients knew.

What You Can (and Can’t) Write Off as a Small Business in Canada

Legitimate CRA deductions for small business.

Should You Incorporate Your Side Hustle?

If your side hustle is starting to feel more like a second career, you might be wondering: Should I incorporate?